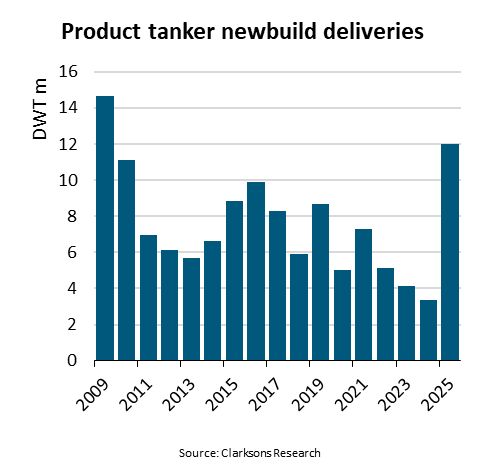

According to current delivery schedules, product tanker newbuild

deliveries are set to reach 12m deadweight tonnes (DWT) in 2025.

Deliveries will therefore jump 256% compared to the 3.4m DWT delivered

in 2024. At the same time, deliveries will reach a 16-year high and the

second highest on record,” says Niels Rasmussen, Chief Shipping Analyst

at BIMCO.

The increase in deliveries follows an increase in contracting of new

ships during 2023 and 2024. During those years 551 new ships were

contracted with a capacity of 38.7m DWT, significantly up from the

yearly average of 122 ships (7.3m DWT) recorded over the previous 10

years.

“The spike in contracting has increased the order book from 10.6m DWT

at the beginning of 2023 to 41.2m DWT at the start of 2025. During the

same period, the order book to fleet ratio rose from 6% to 22%,” says

Rasmussen.

During the last two years, the MR segment attracted the most orders

with 278 ships contracted while the LR2 segment saw the most capacity

ordered with 19.2m DWT.

The two segments also dominate deliveries for 2025 with 98 MRs and 52

LR2s (4.9m and 6.0m DWT respectively) scheduled. Compared to the fleet

size at the beginning of 2025, the scheduled deliveries will add 2%, 6%,

3% and 12% to the DWT capacity of the Handysize, MR, LR1 and LR2 fleet.

Nearly 75% of the ships scheduled for delivery in 2025 were contracted

during the last two years. Despite this, only 7% will be capable of

using alternative fuels while another 12% are being readied for an

eventual retrofit. In the rest of the order book, the share of ships

capable of using alternative fuels is 11%.

During the past five years, recycling activity has been slow, and the

average ship age has increased by more than 2.5 years since the

beginning of 2020. Continued low recycling activity would extend the

lifespan of older tankers while slowing the renewal and decarbonisation

of the fleet.

“The low recycling activity during the past five years has created an

overhang of older ships. Currently, 10% of the fleet’s capacity is

comprised of ships older than 20 years. A return to normal recycling

patterns would significantly increase recycling but continued Russian

sanctions and Houthi attacks in the Red Sea could further delay the

retirement of the oldest ships. We estimate that fleet growth will be

5-6% in 2025 while a decline in oil demand growth will likely result in

product tanker demand growth ending lower,” says Rasmussen.